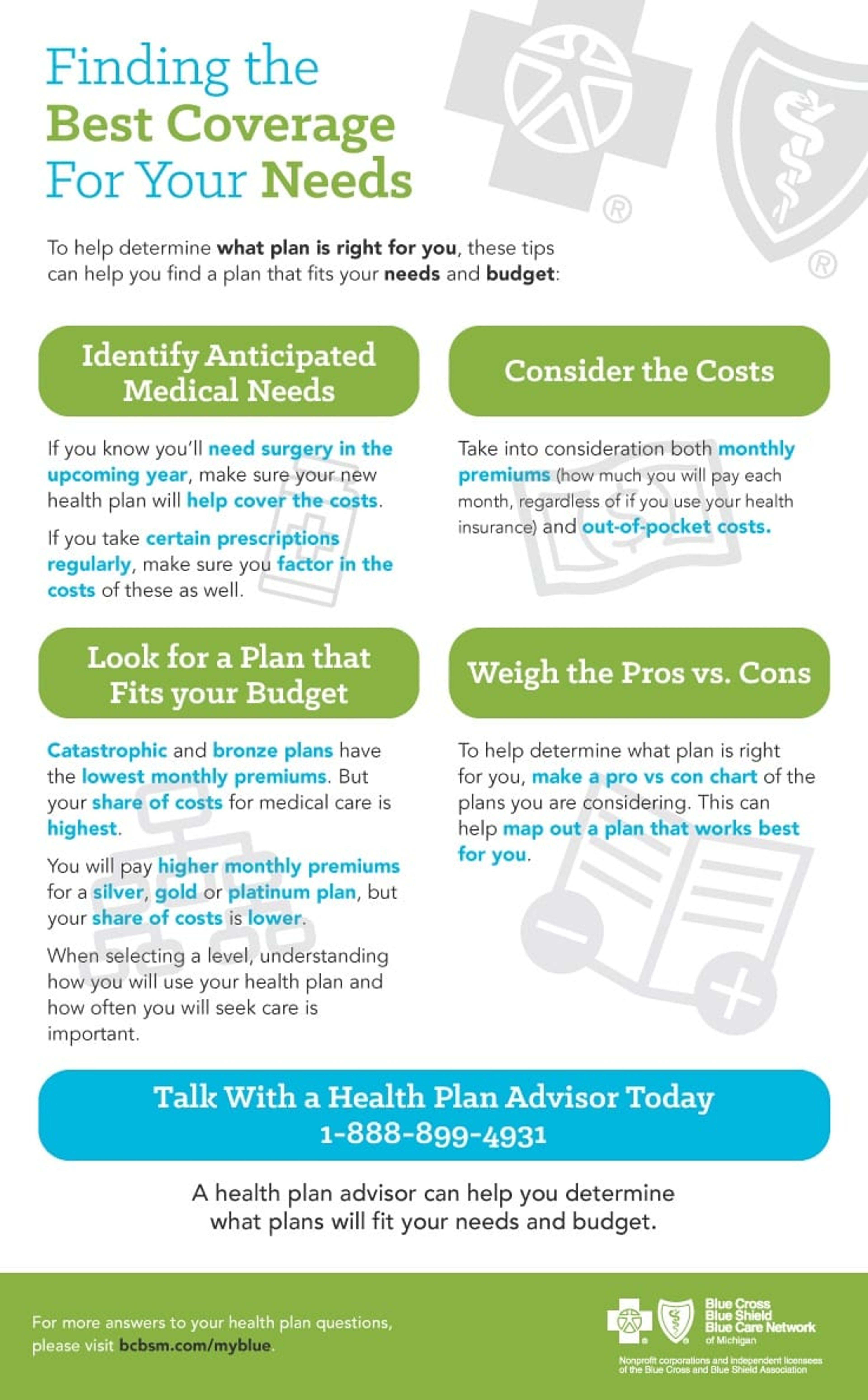

Your 20s can be an exciting time in your life, but with every birthday comes more responsibility. One of those is getting your own health insurance when you are no longer eligible for your parent’s coverage, which for most is age 26. You may think you don’t need a health care plan, but without it, an accident or illness can bankrupt you. Health care can keep your wellbeing covered and finances in check. A slip that leads to a broken arm can cost around $43,000 out of pocket without coverage. Add this cost to student loans and other expenses you have starting out as a young adult, and soon bills become endless and overwhelming. So what do you need to do to ensure you are covered? If you don’t receive insurance through an employer, chances are you’ll have to buy your own plan during a few months out of the year. This window of time, called “open enrollment,” is the yearly period when individuals like you can enroll in a health insurance plan. For 2016 coverage, the Open Enrollment Period is November 1, 2015 – January 31, 2016. You may even be eligible for a subsidy to help pay for your health care coverage. We know health coverage can be overwhelming and confusing, but we’re here to help. First, take a look at everything that goes into selecting a plan:

When you're ready, visit www.bcbsm.com/myblue or call a Health Plan Advisor at 1-888-889-4931 and we can help you understand your needs as an individual outside of your parents’ health plan and get you the coverage that fits your needs. For additional educational resources, visit these posts at www.MIBluesPerspectives.com:

- A Guide for Recent Grads: Should You Stay on Your Parent’s Health Insurance

- What Does My Health Plan Cover?

Photo credit: Sharon Sinclair