Which ACA taxes and fees will affect consumers?

bcbsm

| 2 min read

Under the Affordable Care Act (ACA), 25 million Americans are expected to obtain health care on the Marketplace by 2018. Twenty million of these individuals will receive federally-funded subsidies to help pay for their coverage. The federal government will also cover 100 percent of the Medicaid expansion cost for the first three years.

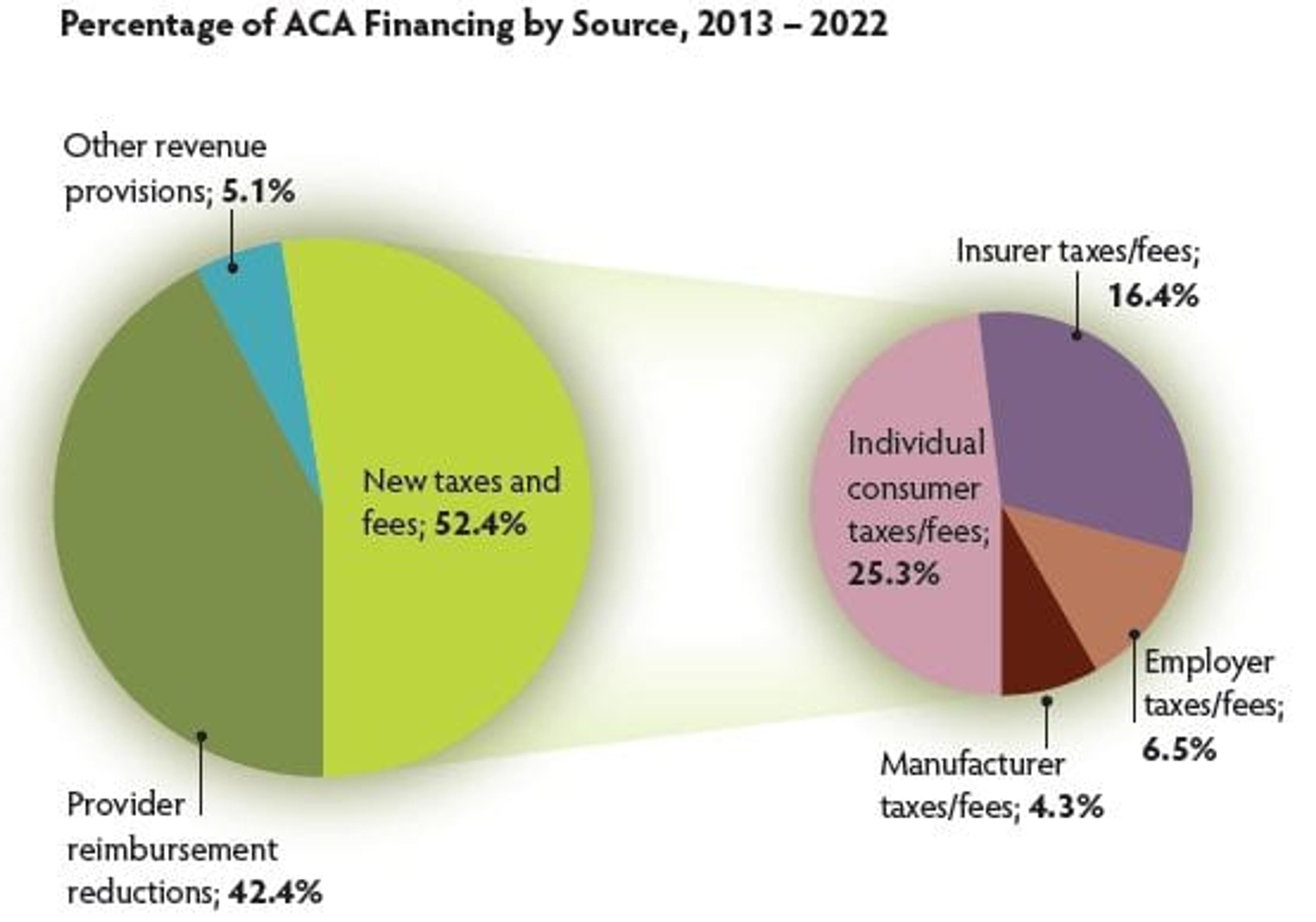

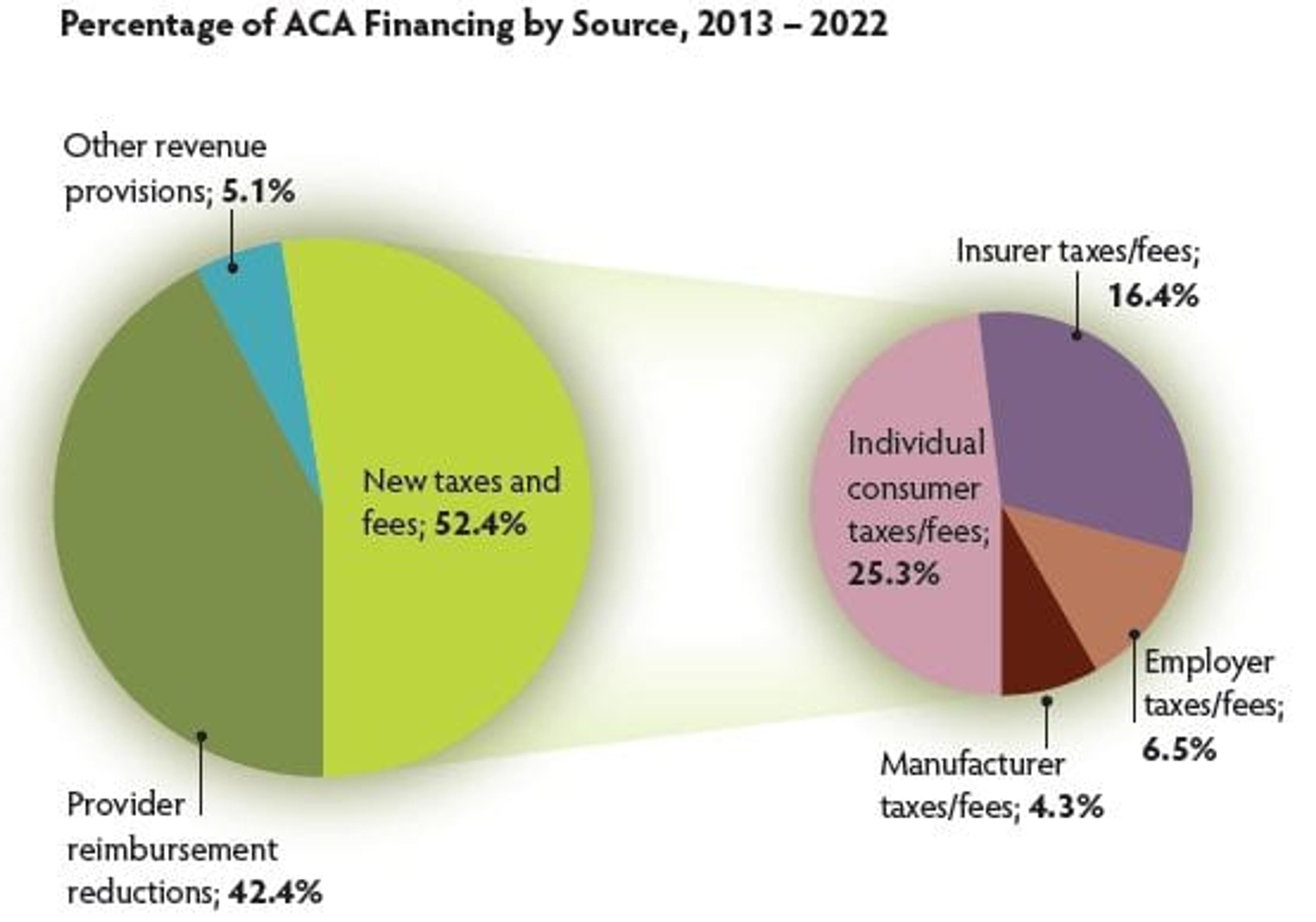

How is it that a law that pays for so much is expected to reduce the deficit by $210 billion in this decade and by more than $1 trillion over the following 10 years? As you can see from the graph to the right, nearly half the cost will be offset by provider reimbursement reductions and other revenue provisions. The other half, however, will be comprised of 13 major new taxes and fees directed towards consumers, employers, manufacturers, and health insurers. The following are taxes that directly apply to consumers:

Though these taxes directly on consumers have the most obvious impact, the cost of taxes placed on insurers, employers, and manufacturers, will likely trickle down as well. For example, the new tax on medical devices may translate into higher prices for consumers or lower compensation for employees. Taxes on insurers may result in increased premiums. The ACA will result in millions of Americans getting health insurance for the first time or having their health insurance expanded. The benefits are large, but it is important to be aware of the taxes and fees that will be subsidizing the costs. For more information regarding health care reform, visit HealthCareReformBasics.com. Photo credit: Center for Healthcare Research & Transformation