For many Americans, the ins-and-outs of finding individual health care coverage is confusing. Paired with the extensive amount of health care-related terminology, navigating health care plan options, understanding tax penalties and going through sign-up procedures is no walk in the park. Blue Cross Blue Shield of Michigan looks to ease the process by providing our members with as much information as possible. Our health plan advisors, who assist members on a daily basis, answered some of the most commonly asked questions. Here’s a list of the most frequently asked questions with the answers you need:

- What made the prices go up? Under the Affordable Care Act, health insurance has become a consumer product available to purchase by individuals–like anything you buy at retail. Just as underlying costs, like raw materials and labor costs, add up to a vehicle’s sticker price, there are a variety of unseen costs driving up the price people pay for health insurance. Things like use of care and expensive specialty drugs are examples that contribute to increases monthly premiums. If your health care premium increased, you have options. Explore other plans or contact your health plan directly to find one that better meets your financial and health needs. Remember, financial help is available. Nearly 80 percent of Marketplace enrollees received financial assistance last year. A recent Citi Research report projects millions of Americans will be able to purchase health insurance this year for less than the penalty for not having insurance. If you don’t have coverage in 2016, you’ll pay a penalty of 2.5 percent of your yearly household income (HHI) or $695, whichever is higher. This is up from $325/2 percent of HHI for not having coverage in 2015.

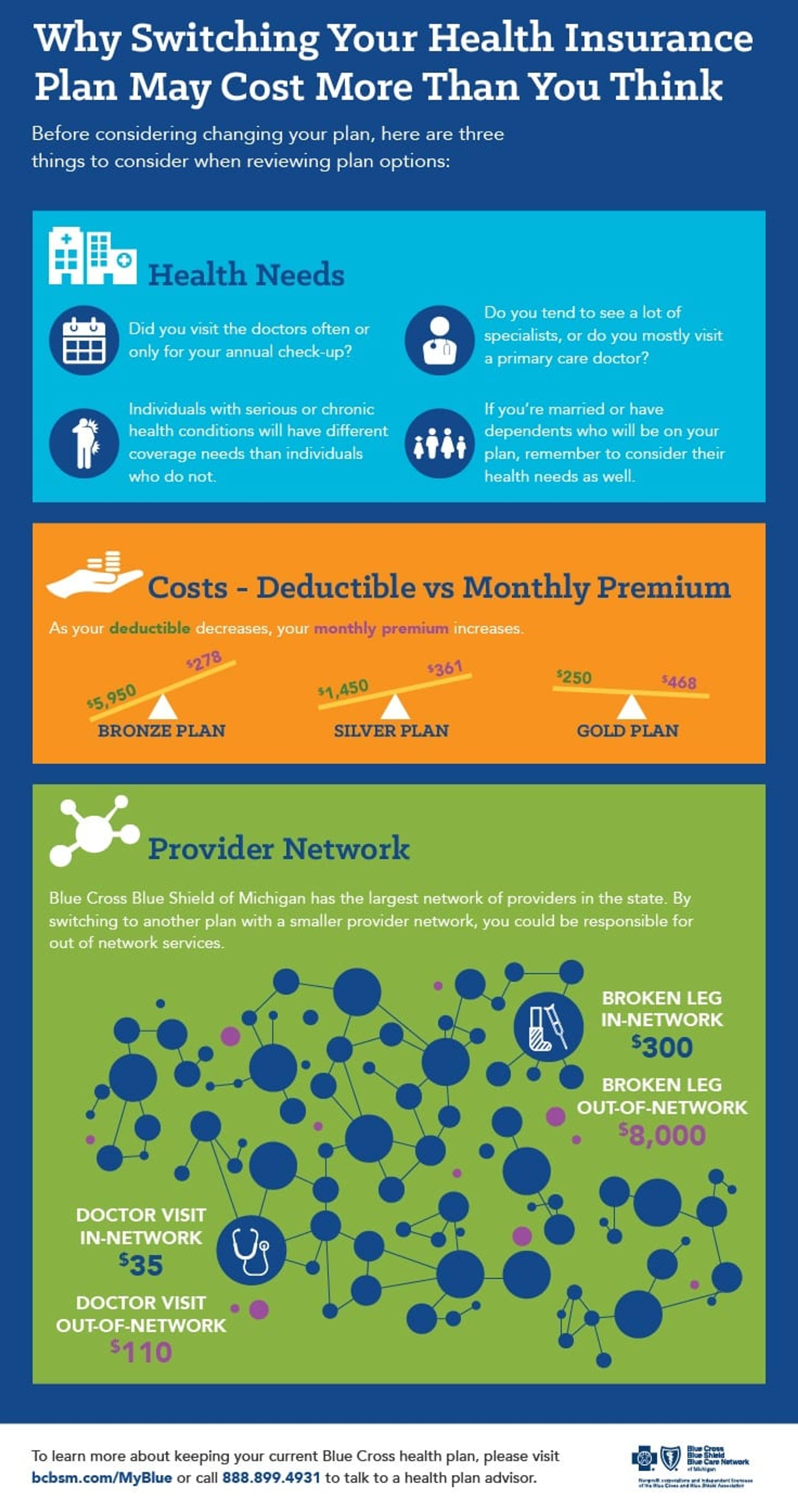

- What’s the right plan for me? To determine what plan is right for you, think about how you’ve utilized health care in the past. Make a list of health care services you used in the last year, including any prescriptions you need filled on a regular basis. Do you or anyone in your family have a chronic condition or anticipate surgery in the coming year? Do you have a preferred doctor or hospital? How often do you see the doctor? Answering these types of questions will help you select the best plan for you. Not sure whether you should switch at all? Here's another way to consider your plan options:

- Why do I have to re-determine my tax credit? While automatic renewal may seem like an easy time-saver, it’s important to re-determine your tax credit every year. Changes in marital status, income, having a child and where you live could increase, lower or eliminate the amount of subsides you qualify for, as well as which plans are available to you. Even if your income stayed the same, the amount of financial assistance you’re eligible for may still increase or decrease based on the cost of plans offered in your area. If you don’t re-determine your subsidy, you may end up owing money at tax time.

- Why is my plan ending? Under the Affordable Care Act, plans are measured by the government on coverage relative to the cost of the plan. This information is used to put plans into four categories: Bronze, Silver, Gold and Platinum. If a plan is determined too generous for its category, it is required to be adjusted or in some cases replaced.

- Why didn’t I get a subsidy this year when I’ve gotten one for the past two years? There are a variety of factors, like household income and the cost of health plans in your region, that affect whether or not you qualify for a subsidy. If a person received a subsidy in 2014 but has not yet filed their federal income taxes for that year, they would stop receiving their subsidy until those taxes are filed.

- Is there a penalty if I provide an incorrect income? If a consumer does not provide accurate information to the Marketplace, the amount will be rectified at tax time. If a consumer received less subsidy assistance than they should have based on their actual income, they may receive additional funds on top of their tax return. If a consumer received more subsidy assistance than they should have, they may be required to “pay back” those funds at tax time.

- What is an embedded deductible? Under family coverage, an embedded deductible is the individual deductible for each covered person, embedded in the family deductible. A family typically has to reach their family’s deductible before the insurance company starts to pay a portion of covered expenses. In plans with an embedded deductible, the insurance company starts to pay a portion of one family member’s expenses if they meet their individual deductible.

- What is the difference between an HMO and PPO? PPO, or preferred provider organization, plans often have higher overall costs, but give consumers lots of flexibility in which doctors and hospitals they choose. HMO, health maintenance organization, plans are often a less expensive option, in which you pick one primary care physician and all health care services go through that doctor. In order to see another health care provider or specialist, you’ll need a referral from that primary doctor or your insurance may not cover the cost.

- Can I keep the same doctors if I change networks? Before changing networks, check with your preferred doctors to see if they accept the new plan you’re interested in.

If you still have questions regarding your plan, our health plan advisors are eager to help. Contact them at 888-899-4931, you can also check out plan options on bcbsm.com/myblue. To learn more, check out these posts:

- Insure the Whole You

- Open Enrollment Goes Live on Social with HPA Chat

- Open Enrollment: Deadlines You Need to Know for 2016

Photo credit: Roland O'Daniel