Good businesses always seek to do right by their customers. This often makes for tough business decisions – because sometimes, what’s good for some customers isn’t necessarily good for all. The best businesses try to find that balance where everyone is served well. As Blue Cross Blue Shield of Michigan moves forward with some significant increases in the cost of premiums for some of our most loyal customers – the nearly 200,000 members enrolled in our Medicare supplement plans known as “Legacy Medigap” – we want to take this opportunity to explain how we came to this decision and how moving forward best serves the collective interest of our more than 5 million members. To see the full picture, it’s important to put all the parts into perspective. How Legacy Medigap Is Priced Today The premiums our members pay for Legacy Medigap today are artificially low for two reasons:

- First, because for the past five years they have been frozen by an agreement between Blue Cross and the state of Michigan. Health care costs have risen over that time, but premiums haven’t changed.

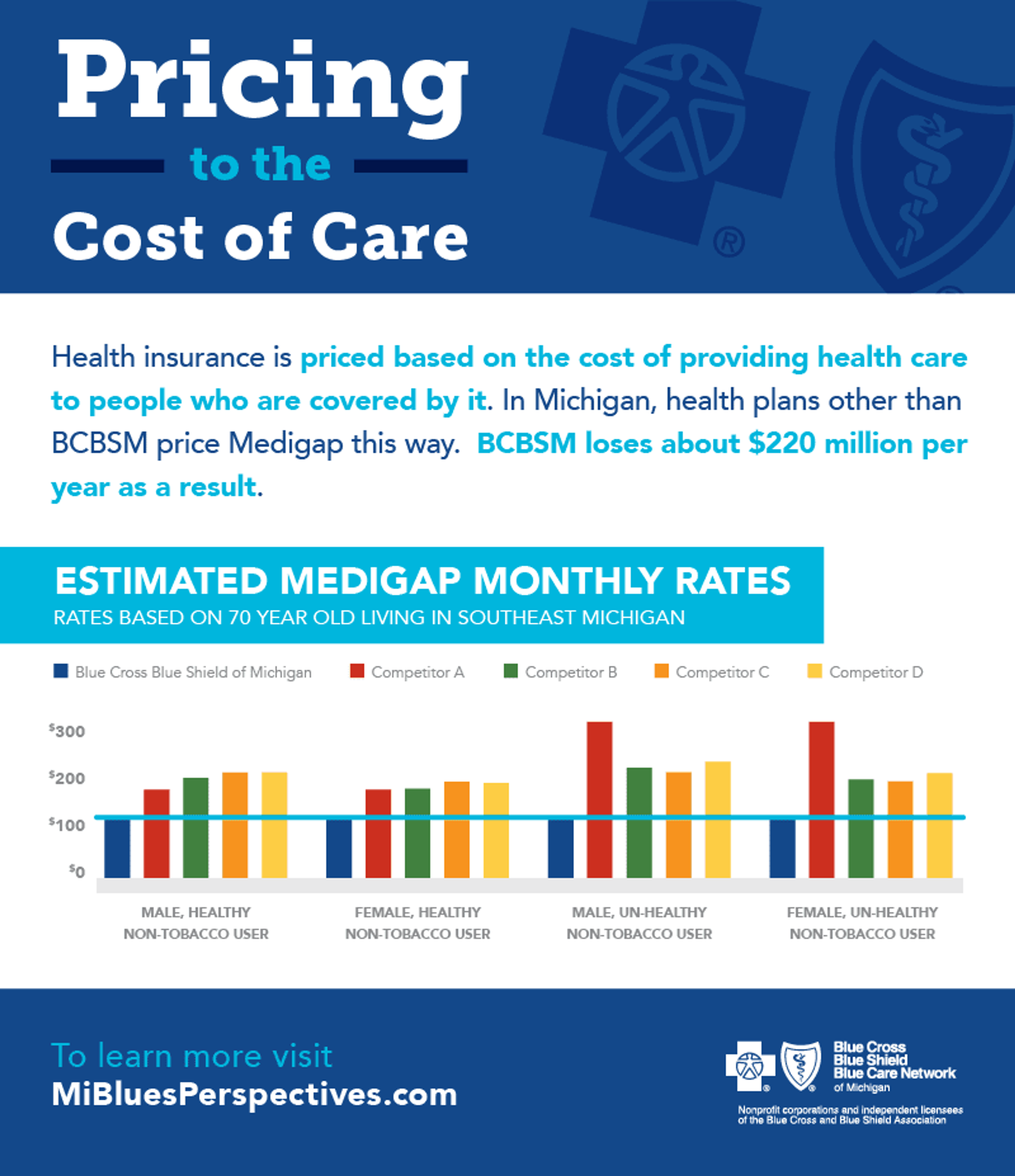

- Second, because under an old regulatory law, Blue Cross was required to subsidize Medigap by absorbing financial losses that result from our premiums not being enough to cover the cost of health care for our covered members. In Legacy Medigap, health care costs were higher than premium revenue by about 150 percent in 2015 – totaling more than $200 million in losses.

Medigap Subsidies and Blue Cross’ Historic Mission Blue Cross has been a mainstay of Michigan health care for 77 years – providing security and confidence to generations of people. Over that time, we have grown to be a large business, but we have also maintained the character of a nonprofit. Today, our nonprofit mission continues to be focused on helping everyone in Michigan obtain access to quality health care, and improving the health of our state’s people and communities. In 1980, a state law was enacted that put some requirements around Blue Cross’ nonprofit mission. That law extended the company’s state and local tax exemptions as a nonprofit. In return, the company was required, among other things, to subsidize Legacy Medigap. Medicare Expands Options for Beneficiaries Back in 1980, Medigap plans were the only option available to seniors for filling the gaps in their Medicare benefit. In the 2000s, however, Congress enacted changes to the Medicare system. New plan options were introduced. These plans dramatically broadened the Medicare benefit and offered a significant number of choices that exist today in an open and competitive market. Some of these new plans offer more comprehensive coverage, including dental and vision coverage. Medigap plans were no longer the only option for beneficiaries. They were just one of many options for coverage. Changes in State Law Restructure Blue Cross’ Requirements In 2013, the state of Michigan passed a new law regulating Blue Cross. This law ended the company’s tax-exempt status. As a result, we paid more than $100 million in state and local taxes in 2015. In return for the company paying taxes, the old requirements of the 1980 law were abolished – including the requirement that we subsidize Legacy Medigap. New requirements were put into place. One of the new requirements of the 2013 law is that Blue Cross provide $1.56 billion over 18 years to support a newly created and independent nonprofit – the Michigan Health Endowment Fund. Blue Cross has paid $210 million to the Endowment Fund so far. The requirement to subsidize Medigap coverage now applies to the Health Endowment Fund, not Blue Cross. Vulnerable People Still Benefit from Medigap Subsidies The mission of the Health Endowment Fund is to protect the health of people in Michigan who are vulnerable. The Health Endowment Fund worked hard with Blue Cross, senior advocates and our health plan competitors to structure a subsidy for Medigap that helps people who need help the most. We are very pleased that some of the money we have provided the Health Endowment Fund for Medigap subsidies will help people with disabilities and seniors who earn below $26,730 for an individual or $36,045 for a couple. You can learn more about the new Medigap subsidy here. The Market Benefits Medigap plans in Michigan are offered by a number of different companies. The plans are regulated by the federal government, so the benefits are fairly consistent regardless of the company providing the coverage. The only difference in Michigan for 36 years has been the price – with Blue Cross’ artificially low premiums for Legacy Medigap giving us an edge in attracting and retaining membership. Our competitors charge market rates for Medigap that approximate health care costs for their members. Soon, we will be pricing our products using the same standard. Our Customers Benefit As a nonprofit mutual, Blue Cross tries to manage our financial performance to very small margins of profitability. In 2015, we lost $68 million overall – including $220 million on Legacy Medigap. Even when our new pricing takes effect, Blue Cross projects that premium revenues still will fall below what we need to cover medical claims and costs. It’s a delicate balance. We try to keep health coverage affordable for each of our more than 5 million members, pay the taxes now required by the law, make our annual payments to the Health Endowment Fund to protect people and subsidize Medigap for the vulnerable, and have capital to invest in improving our business. Improving our financial performance on Medigap will help all of our customers over the long term. We are making this change at a time when Medicare beneficiaries have more choices for coverage than ever before. As we move forward, we are committed to working hand-in-hand with our Legacy Medigap members and their families, with the committed advocates serving seniors and persons with disabilities, and with state regulators and the Health Endowment Fund. Working as a trusted partner to help people make fully informed choices and getting the coverage that best meets their needs has been a hallmark of our company’s approach since 1939. We’re redoubling that effort now.