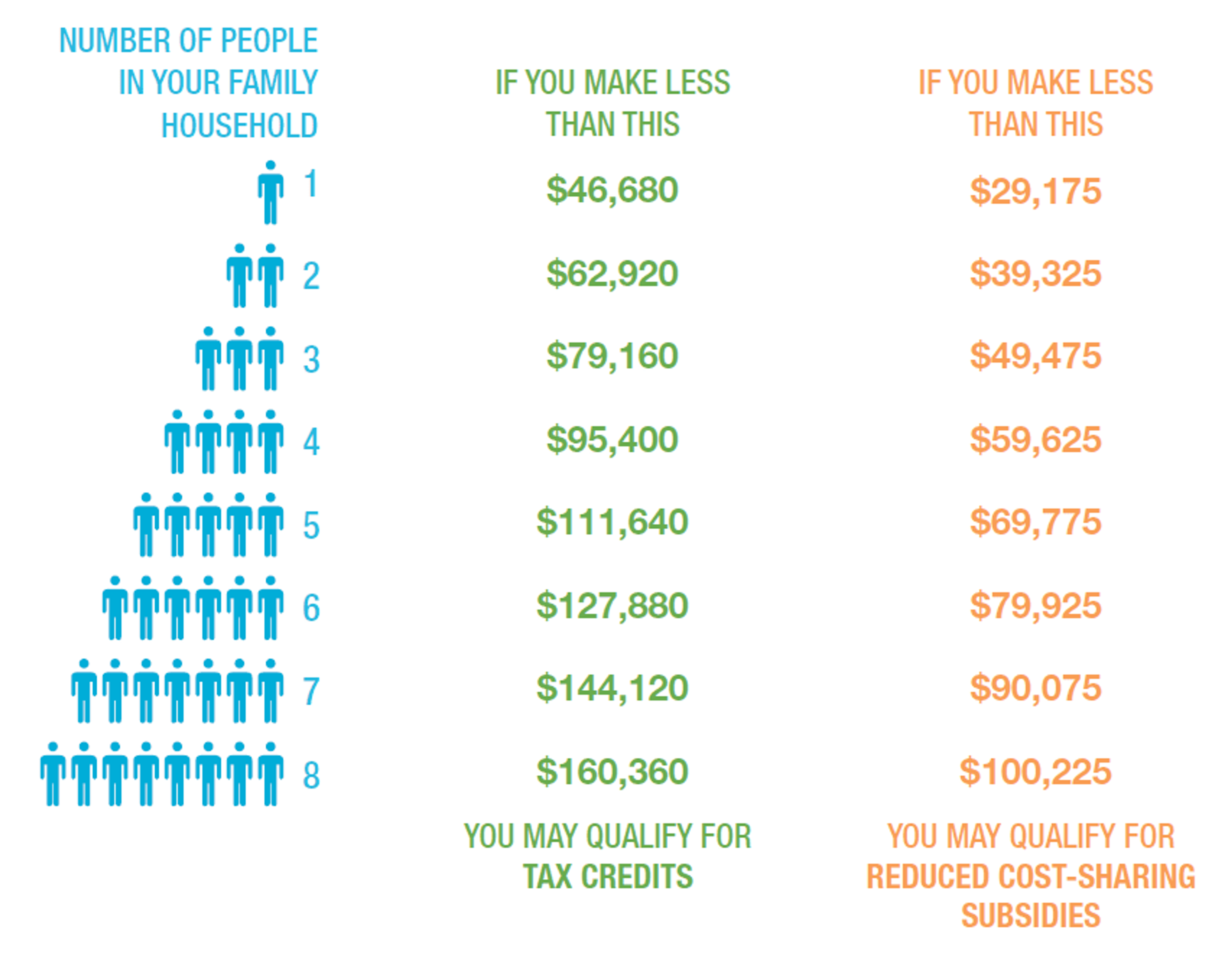

Eligible U.S. citizens and legal residents can purchase a health plan through the Health Insurance Marketplace. Depending on annual household income and other factors defined by the Affordable Care Act, individuals and families may be eligible for lower costs on the Marketplace. Two types of financial help are available:

- Advanced premium tax credits help lower the cost of your monthly premium.

- Cost-sharing reductions may lower the amount you have to pay for out-of-pocket expenses, including your deductible, coinsurance and copayments. Cost-sharing reductions may help cover costs such as doctor visits and treatment and are only available on silver plans.

Not sure if you’re eligible?

Use this chart to see if your income is within the range eligible for financial help:

*Income levels are based on 2014 federal guidelines. Guidelines may vary state by state and are updated annually. Different qualifications apply to pregnant women, infants, children and people who are blind or disabled or over the age of 64. Income ranges are applicable for Open Enrollment period beginning Nov. 15, 2014. To see if you qualify for lower costs, visit bcbsm.com/subsidy or text “4Subsidy” to 222-752. You can also call a health plan advisor at 855-237-3501.

Think you don’t need health insurance?

One incident or unexpected trip to the hospital can leave you paying bills for years, and may even lead to filing for bankruptcy. Here are a few reasons why having health insurance is important.

- If you or your family member gets injured or sick, health insurance helps you avoid financial disaster.

- You can choose a doctor to help with your ongoing health care needs.

- Health insurance keeps you and your family healthy with preventive benefits like flu shots and specific screenings.

- You may get help paying for doctor’s visits, hospital visits and necessary prescription drugs with health insurance.

The Affordable Care Act guarantees that individual market health plans, at every insurance level, include at least these 10 essential benefits:

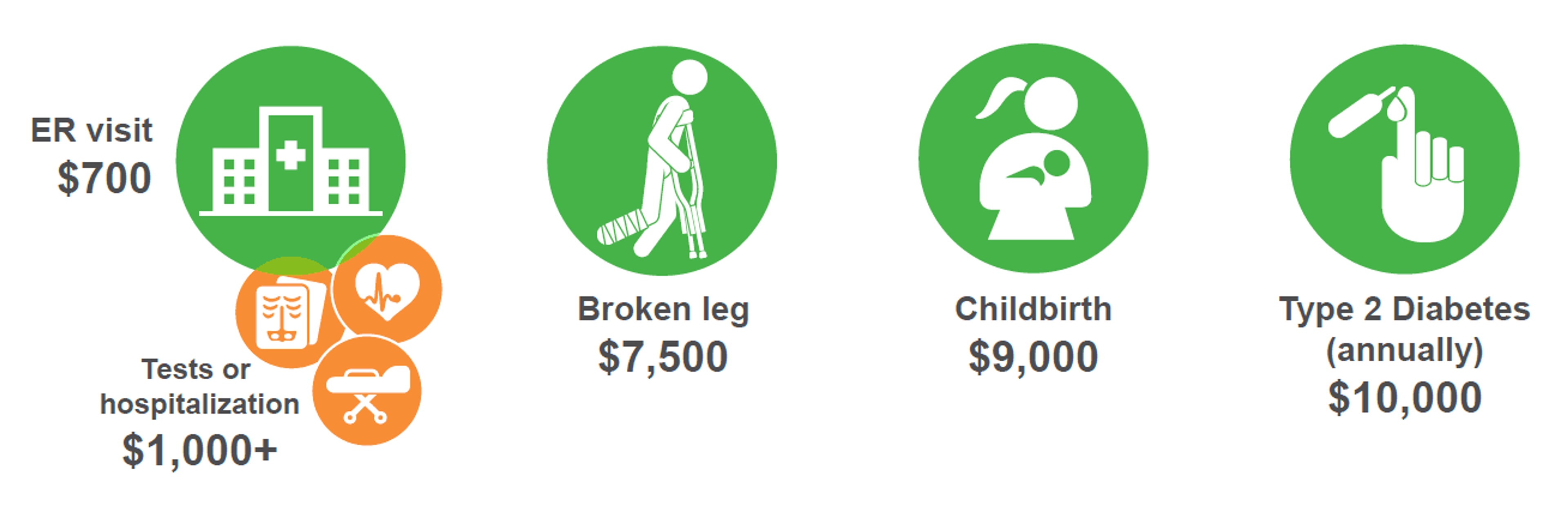

What can happen without health care coverage?

Nearly two-thirds of all bankruptcies in the U.S. are health-care related, and this number grows annually. Here are a few examples of what you might pay if you didn’t have health care coverage:

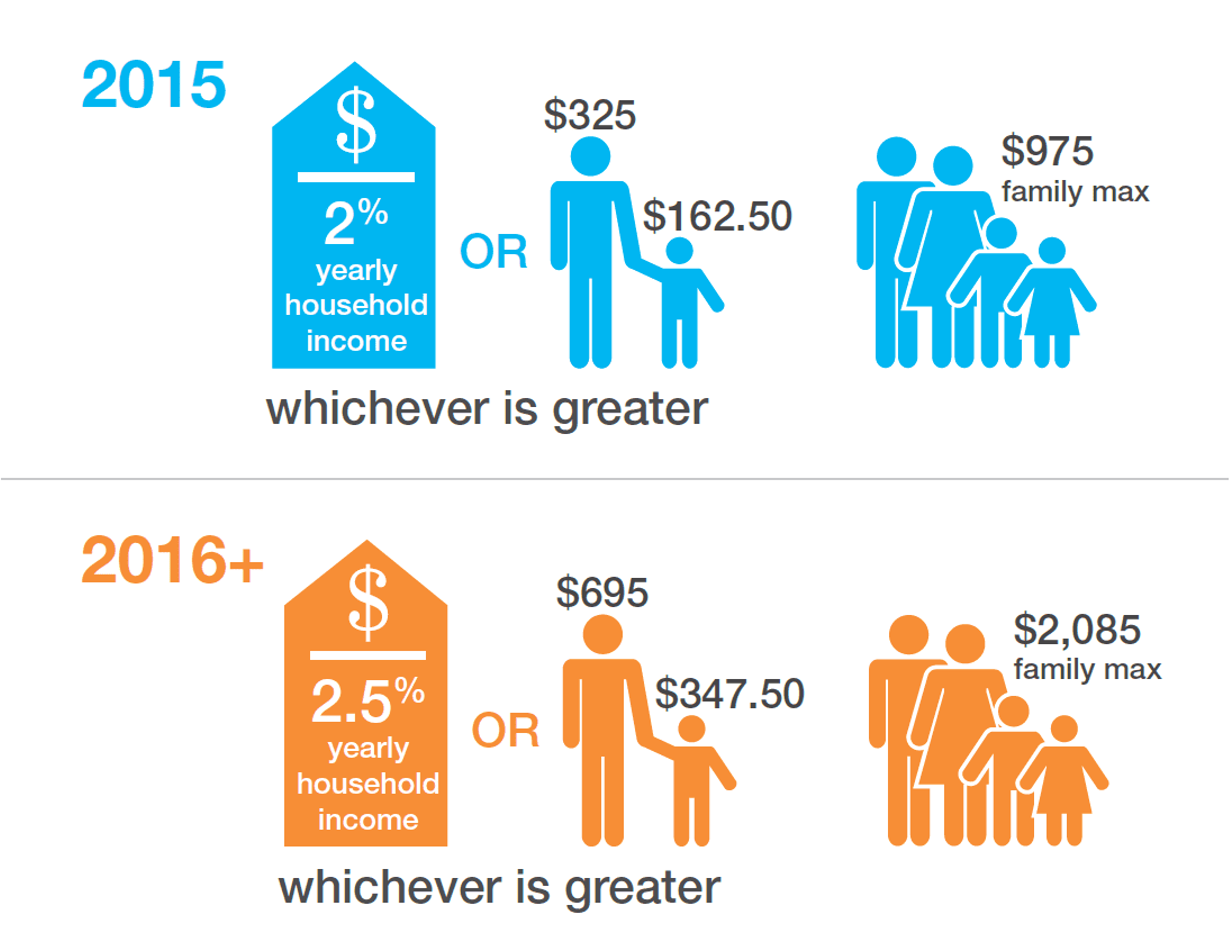

In addition to being vulnerable to financial disaster, you may also face a penalty if you have no health care coverage:

For more health insurance tips read our Health Insurance 101 blog series, visit bcbsm.com/101 or follow the hashtag #Covered101 on our social channels. If you have a specific question, please submit your query online through our Customer Action Center.